NFT Royalties Explained: Comprehensive Guide

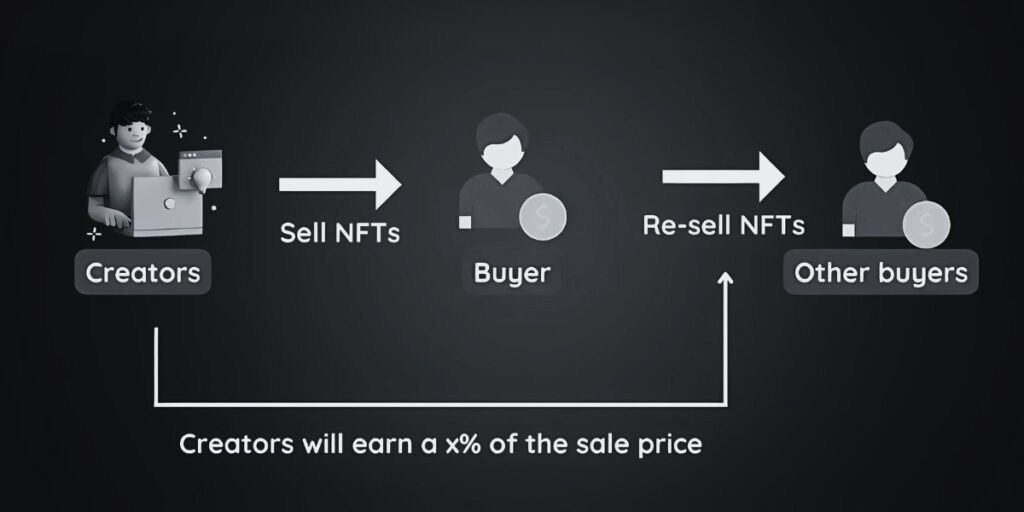

NFT royalties are automatic payments made to the original creator whenever their digital asset is resold on the secondary market. Unlike traditional art sales where artists rarely benefit from future appreciation of their work, NFT royalties give creators a percentage of each subsequent sale, providing ongoing revenue streams and transforming the economics of digital creation.

How NFT Royalties Work

NFT royalties function through smart contracts—self-executing code on the blockchain that automatically distributes a percentage of each sale to the original creator. These smart contracts ensure that creators receive royalties without requiring intermediaries or manual enforcement.

When an artist mints an NFT, they set a royalty percentage (typically between 5-10%). Each time the NFT changes hands on supported platforms, the smart contract automatically calculates the royalty amount and transfers it to the creator’s wallet address.

Types of NFT Royalties

NFT royalties can be implemented in several ways, each with distinct characteristics:

| Type | Description | Implementation | Platforms |

|---|---|---|---|

| On-chain | Coded directly into the NFT’s smart contract | Most secure, enforced by blockchain | Ethereum (ERC-2981), Tezos |

| Off-chain | Enforced by marketplace policies | Less secure, platform-dependent | OpenSea, Rarible, Foundation |

| Hybrid | Combination of on-chain verification with off-chain enforcement | Balance of security and flexibility | SuperRare, Nifty Gateway |

Setting Up NFT Royalties

To set up royalties for your NFTs, follow these steps:

- Choose a blockchain that supports royalty standards (Ethereum with ERC-2981, Tezos, Solana)

- Select a marketplace that honors royalty payments

- During the minting process, specify your desired royalty percentage

- Provide an accurate wallet address for receiving payments

- Verify the royalty settings before finalizing your NFT

The optimal royalty percentage depends on your market position and the perceived value of your work. New creators might set lower percentages (2-5%) to encourage sales, while established artists can command higher rates (10-15%).

Benefits and Limitations

Benefits:

- Passive Income: Creators earn money each time their work is resold

- Value Appreciation: Artists benefit from the increasing value of their work over time

- Market Participation: Creators maintain a financial connection to their work

- Sustainable Creativity: Ongoing revenue supports continued artistic production

Limitations:

- Enforcement Challenges: Not all marketplaces honor royalty payments

- Technical Fragmentation: Different blockchains use different royalty standards

- Market Resistance: High royalties may discourage secondary sales

- Cross-platform Issues: Royalties may not transfer when NFTs move between platforms

The Royalty Enforcement Debate

The NFT community continues to debate whether royalties should be mandatory or optional. Here’s where different stakeholders stand:

Pro-mandatory enforcement:

- Creators argue royalties are essential for sustainable digital art economies

- Platforms like Ethereum are developing on-chain enforcement standards (EIP-2981)

- Advocates point to traditional art markets where artists rarely benefit from price appreciation

Pro-optional approach:

- Collectors concerned about market liquidity and transaction costs

- Some platforms like Magic Eden have made royalties optional

- Free market proponents believe competition will determine appropriate royalty levels

The Future of NFT Royalties

The royalty landscape is evolving rapidly with several emerging trends:

- Stronger Standards: New blockchain standards like ERC-2981 aim to improve cross-platform compatibility

- Programmable Royalties: Advanced smart contracts enabling royalties that change over time or after certain conditions

- Split Royalties: Systems allowing multiple creators or stakeholders to receive portions of royalty payments

- Royalty Registries: Centralized databases helping platforms identify and honor creator royalties

- Legal Recognition: Increasing integration of NFT royalties into copyright and intellectual property frameworks

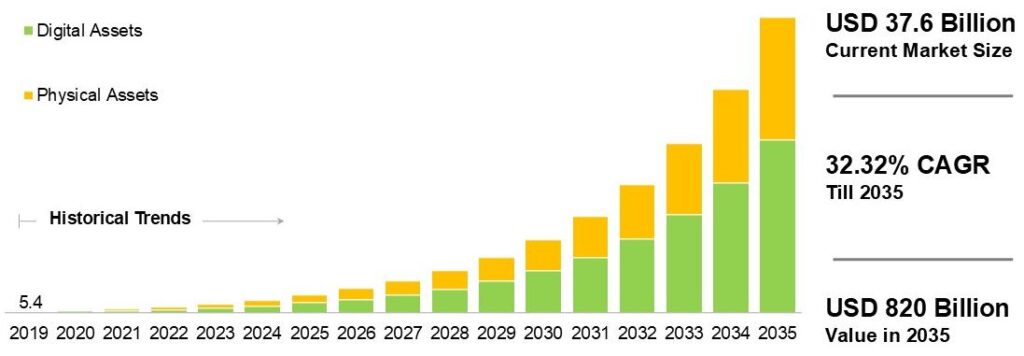

NFT Market

By type of NFT, till 2035 (USD Billion)

FAQ

Can I change my royalty percentage after minting an NFT?

Generally, no. Royalty percentages are typically set during the minting process and become permanent once the NFT is created. This immutability is part of the blockchain’s design to ensure trust and transparency. Some newer platforms are experimenting with adjustable royalties, but these are not yet widely adopted.

Do I receive royalties when my NFT is transferred as a gift?

Most royalty mechanisms only trigger during sales involving payment. When an NFT is transferred as a gift (with no payment), royalties usually aren’t generated. However, this depends on the specific implementation of the marketplace and smart contract.

How do I track my NFT royalty payments?

You can track royalty payments through:

- The marketplace dashboard where you minted your NFT

- Blockchain explorers by searching your wallet address

- Specialized NFT analytics platforms like NFTScan or Moonstream

- Notifications from your connected wallet

Are NFT royalties taxable income?

Yes, in most jurisdictions, NFT royalties are considered taxable income. They may be classified as either royalty income, self-employment income, or capital gains depending on your location and specific circumstances. Consult with a tax professional familiar with cryptocurrency and digital assets for guidance on your particular situation.

What happens to my royalties if a marketplace shuts down?

This depends on how your royalties are implemented:

- On-chain royalties (embedded in the NFT’s smart contract) will continue to function regardless of which marketplace is used for trading

- Off-chain royalties (enforced by marketplace policies) will no longer be paid if that marketplace ceases operations

- Your NFT can still be traded on other platforms, but royalty enforcement will depend on whether those platforms honor your royalty settings