How to Research Crypto Projects: A Comprehensive Guide

Cryptocurrency investment requires thorough research before committing your funds. Unlike traditional markets, the crypto space is still largely unregulated, with thousands of projects competing for attention. Some offer genuine innovation and value, while others may be scams or simply poorly conceived ventures with little chance of success. This guide will walk you through a systematic approach to researching crypto projects, helping you make informed decisions based on fundamental analysis rather than hype or FOMO (fear of missing out).

Understanding the Project Fundamentals

The first step in researching any crypto project is understanding what it actually aims to accomplish. This requires investigating several core aspects:

The White Paper Analysis

The white paper is the project’s founding document that outlines its vision, technology, and implementation plan. When analyzing a white paper:

- Check if it clearly articulates the problem the project aims to solve

- Evaluate if the proposed solution is logical and technically feasible

- Look for detailed technical specifications rather than vague promises

- Assess whether the tokenomics (economic model) makes sense

- Verify if citations and references support technical claims

- Note if the roadmap provides realistic timelines

A well-written white paper should be comprehensive yet clear, technically sound without resorting to excessive jargon, and should present a compelling case for why the project needs to exist.

Team Background and Expertise

The people behind a project often determine its success or failure. When evaluating the team:

| What to Check | Why It Matters | Red Flags |

|---|---|---|

| Professional backgrounds | Indicates relevant expertise | Anonymous teams without justification |

| Track record in blockchain/tech | Shows domain knowledge | No team members with technical expertise |

| Previous successful projects | Demonstrates capability | History of abandoned projects |

| Academic credentials | Validates technical claims | Unverifiable credentials |

| Industry connections | Suggests networking ability | No LinkedIn profiles or verifiable histories |

| Advisors and their involvement | Provides additional expertise | Advisors listed without confirmation |

Always verify team credentials independently rather than taking the website’s claims at face value. Search for team members on LinkedIn, GitHub, and other professional platforms to confirm their experience.

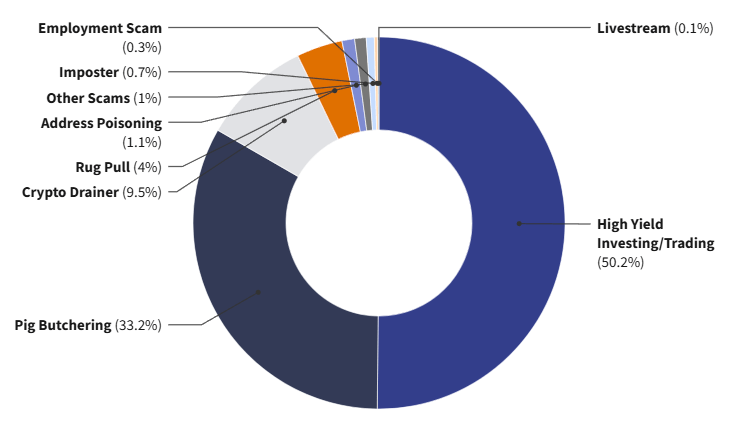

Crypto Fraud

Technical Assessment

Code Repository Analysis

For technical projects, examining their code repositories is crucial:

- Check if the code is open-source and accessible on platforms like GitHub

- Evaluate code activity: frequent commits suggest active development

- Look at the number of contributors and their expertise

- Review issues and how quickly they’re addressed

- Check for security audits by reputable firms

- Examine test coverage and documentation quality

Active repositories with multiple contributors and regular updates generally indicate healthy projects. Conversely, inactive repositories or ones with minimal contributions might suggest the project is not being actively developed.

Blockchain Infrastructure and Architecture

Understanding the technical architecture helps assess a project’s viability:

- Is it built on an established blockchain or its own?

- What consensus mechanism does it use and why?

- How does it address scalability and security?

- What programming languages and frameworks are used?

- Does it implement innovative technical solutions?

- How interoperable is it with other blockchain systems?

These factors determine the project’s ability to deliver on its promises and adapt to the evolving blockchain landscape.

Tokenomics and Economic Model

The economics of a crypto project can reveal much about its long-term viability:

Token Distribution and Supply Mechanics

Analyzing token allocation helps identify potential centralization or dump risks:

- What percentage goes to team, investors, and community?

- What is the vesting schedule for team and investor tokens?

- Is there a maximum supply cap or is it inflationary?

- How are new tokens created and distributed?

- What percentage was sold in public vs. private sales?

- Are there token burning mechanisms?

A healthy distribution typically allocates a significant portion to the community while ensuring team members have sufficient skin in the game with reasonable vesting periods.

Token Utility and Value Capture

The token’s purpose within the ecosystem determines its long-term value:

- Does the token have clear utility beyond speculation?

- Is the token necessary for the project’s functionality?

- How does the token capture value from the project’s growth?

- Are there staking, governance, or other incentive mechanisms?

- Could the project function without its token?

Projects where the token is an integral part of the ecosystem generally offer better long-term investment potential than those where the token feels bolted on as an afterthought.

Market Position and Adoption

Competitive Landscape Analysis

Understanding a project’s position relative to competitors is essential:

- Who are the main competitors in this niche?

- What unique advantages does this project offer?

- How saturated is the market segment?

- Is there sufficient market demand for this solution?

- How does the project differentiate itself?

Few crypto projects exist in isolation. Understanding the competitive landscape helps assess whether a project has a realistic chance of capturing market share.

Adoption Metrics and User Base

Actual usage is one of the strongest indicators of a project’s health:

- Number of active users or wallets

- Transaction volume (excluding wash trading)

- Developer activity and third-party integrations

- Growth trends over time rather than absolute numbers

- Partnership quality and implementation status

- Community size and engagement levels

Projects showing consistent growth in real usage typically outperform those relying solely on marketing and hype.

Community and Communication

Community Health Assessment

A project’s community often reflects its prospects:

- Size and activity in Discord, Telegram, or forum discussions

- Quality of technical discussions vs. price speculation

- Community governance participation rates

- Response to criticism and handling of setbacks

- Balance between marketing and technical communications

- Geographic and demographic diversity

Vibrant communities with substantive discussions generally indicate stronger projects than those focused solely on price action and marketing.

Communication Transparency

How a project communicates reveals much about its integrity:

- Regular and detailed development updates

- Transparent handling of setbacks and challenges

- Realistic promises vs. overhyped marketing

- Accessibility of team members to the community

- Clear explanations of technical concepts

- Consistent messaging across different platforms

Projects that communicate transparently even during challenging times demonstrate greater integrity than those that appear only during positive developments.

Risk Assessment Tools

Security Audits and Vulnerabilities

Security is paramount in cryptocurrency investments:

- Have smart contracts been audited by reputable firms?

- Were audit findings addressed adequately?

- Has the project suffered previous security incidents?

- Does the project have bug bounty programs?

- Is there multi-signature control of treasury funds?

- Are there time-locks or other security mechanisms?

Multiple audits from different firms provide stronger security assurances than single audits or none at all.

Regulatory and Compliance Considerations

Regulatory risks can significantly impact a project’s viability:

- Does the project comply with relevant regulations?

- Has the team proactively engaged with regulators?

- Are there geographic restrictions for token holders?

- Could the token be classified as a security?

- Does the project handle KYC/AML appropriately?

- Are there contingency plans for regulatory changes?

Projects that take compliance seriously may face fewer obstacles to mainstream adoption in the long run.

Additional Research Perspectives

Expert Opinions and Third-Party Analysis

While forming your own conclusions is important, expert perspectives can provide valuable context:

- Research reports from crypto investment firms

- Technical analyses from respected blockchain researchers

- Commentary from industry leaders on Twitter/social media

- Academic papers examining the project’s technology

- Criticisms and counterarguments from technical experts

Look for balanced analyses that consider both strengths and weaknesses rather than purely promotional content.

Macro Trends and Timing Considerations

Individual projects exist within the broader crypto ecosystem:

- How does the project align with macro blockchain trends?

- Is the project ahead of its time or perfectly timed?

- How would broader crypto market cycles affect it?

- Does it address emerging needs in the blockchain space?

- How resilient would it be during market downturns?

Understanding these contextual factors helps assess whether a project is positioned for success in the current environment.

Frequently Asked Questions

How much time should I spend researching a crypto project before investing?

Thorough research typically requires several hours spread over multiple days. For significant investments, spending 10-20 hours researching a single project isn’t excessive. Breaking this into segments allows you to revisit your analysis with fresh eyes. More complex or technically ambitious projects may require even more research time. Remember that inadequate research is one of the primary reasons investors lose money in cryptocurrency.

What are the biggest red flags to watch for when researching crypto projects?

Major red flags include anonymous teams without legitimate reasons for anonymity, unrealistic promises of returns, excessive focus on price rather than technology, plagiarized code or white papers, centralized token distribution favoring insiders, lack of technical documentation, and absence of working products despite lengthy development timelines. Additionally, be wary of projects that constantly shift focus or repeatedly delay major milestones without transparent explanations.

How can I verify if a project’s partnerships are legitimate?

Always seek confirmation from both parties. Check the partner company’s official channels (website, social media, press releases) for announcements about the partnership. Be skeptical of partnerships announced only by the crypto project. Contact the purported partner directly if necessary. Legitimate partnerships typically include specific details about implementation rather than vague statements about “exploring opportunities.” Remember that many announced partnerships are actually just informal discussions or memorandums of understanding without binding commitments.

Should I trust influencers and YouTube analysts when researching crypto projects?

Approach influencer recommendations with extreme caution. Many receive compensation for promotions without disclosing it. Use influencer content as a starting point for projects to investigate, but never as the sole basis for investment decisions. Look for analysts who provide balanced perspectives including potential weaknesses, demonstrate technical understanding, and have a track record of objective analysis. The most reliable content creators typically focus on explaining technology rather than making price predictions.

How can I assess projects in highly technical fields like zero-knowledge proofs or layer-2 scaling solutions if I lack technical expertise?

Start by building foundational knowledge through educational resources. For highly technical projects, seek analyses from multiple technical experts rather than relying on a single opinion. Focus on understanding the problem being solved and whether the approach makes conceptual sense. Evaluate the team’s expertise specifically in the relevant technical domain. Look for explanations aimed at different technical levels and see if they remain consistent. When you encounter technical concepts you don’t understand, take time to research them individually rather than glossing over them.