Proof of Stake vs. Proof of Work: Understanding Blockchain Consensus Mechanisms

Blockchain networks need a reliable method to validate transactions and add new blocks to the chain without central authority. Two dominant approaches have emerged: Proof of Work (PoW) and Proof of Stake (PoS). These consensus mechanisms fundamentally shape how blockchains operate, determine their environmental impact, and influence their scalability. As the blockchain industry evolves, understanding the differences between these systems has become increasingly important for investors, developers, and users alike.

Fundamentals of Consensus Mechanisms

At their core, both PoW and PoS serve the same purpose: securing blockchain networks by preventing attacks and ensuring agreement on the transaction history. However, they take radically different approaches to achieve this goal.

Proof of Work (PoW)

Introduced with Bitcoin in 2009, Proof of Work requires participants (miners) to solve complex mathematical puzzles using computational power. This process:

- Demands significant energy consumption

- Requires specialized hardware (ASICs)

- Rewards the first miner to solve the puzzle with newly minted coins and transaction fees

- Secures the network through the economic cost of the hardware and electricity required to participate

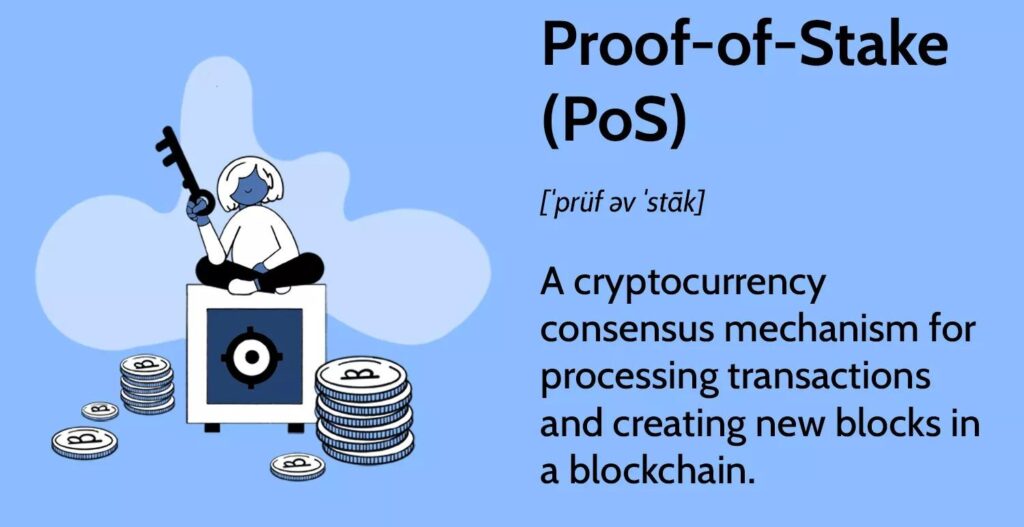

Proof of Stake (PoS)

Developed as an alternative to PoW’s energy-intensive process, Proof of Stake selects validators based on the amount of cryptocurrency they pledge (stake) to the network. This approach:

- Requires minimal energy consumption

- Doesn’t need specialized hardware

- Rewards validators with transaction fees and sometimes new coins

- Secures the network through economic penalties for malicious behavior (slashing)

Key Differences: PoW vs. PoS

| Feature | Proof of Work | Proof of Stake |

|---|---|---|

| Selection Method | Computational competition | Economic stake |

| Resource Investment | Hardware + electricity | Cryptocurrency holdings |

| Energy Consumption | Very high | Low |

| Hardware Requirements | Specialized mining equipment | Standard computers |

| Entry Barrier | High initial investment | Minimum stake requirement |

| Security Model | 51% attack requires majority hash power | 51% attack requires majority of staked tokens |

| Network Participation | Limited to those with mining equipment | Open to anyone with tokens |

| Decentralization Tendency | Mining pools centralization | Potential concentration among wealthy stakeholders |

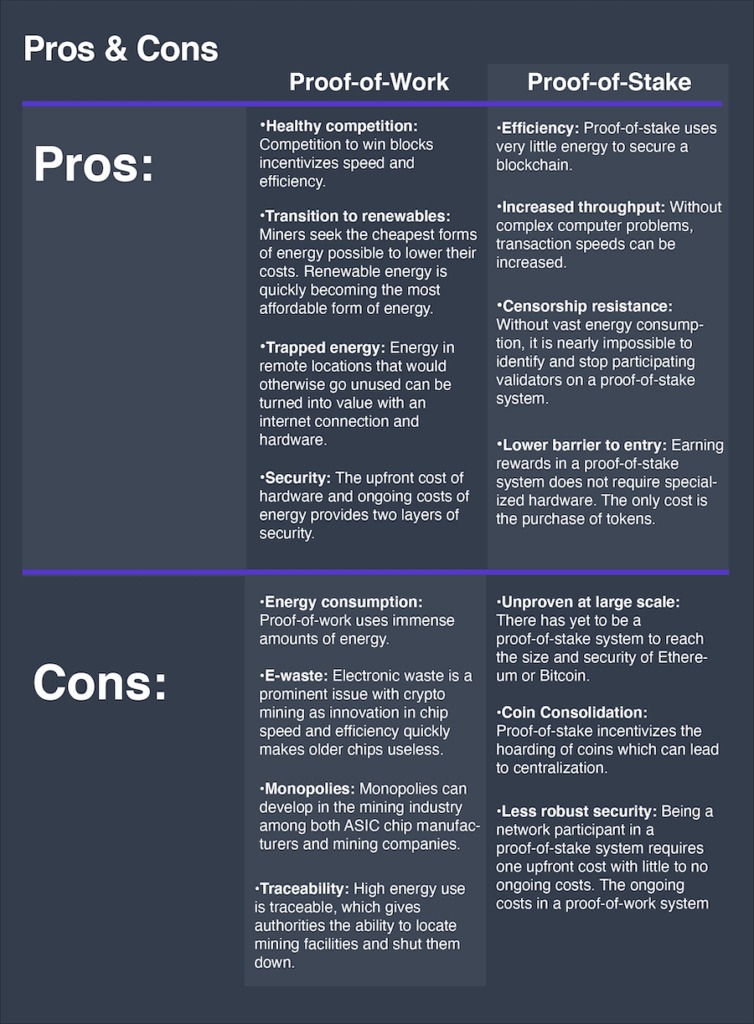

Environmental Impact

The environmental consequences of blockchain consensus mechanisms have become a major point of contention in recent years.

PoW Environmental Footprint

Bitcoin’s Proof of Work has drawn significant criticism for its energy consumption:

- Bitcoin alone consumes more electricity than some countries

- The Cambridge Bitcoin Electricity Consumption Index estimated Bitcoin’s annual energy consumption at approximately 110 TWh in early 2024

- Mining operations often cluster in regions with cheap electricity, sometimes powered by fossil fuels

- E-waste from obsolete mining equipment compounds the environmental concerns

PoS Sustainability Advantages

The shift to Proof of Stake represents a dramatic improvement in blockchain sustainability:

- Ethereum’s transition to PoS (The Merge) reduced its energy consumption by approximately 99.95%

- PoS networks can operate on standard computer hardware with minimal energy requirements

- The carbon footprint of PoS networks is comparable to typical web services

- No specialized equipment means significantly reduced e-waste

Economic Implications

The choice between PoW and PoS significantly impacts tokenomics, participation incentives, and network security.

PoW Economics

- Creation of a mining industry with specialized hardware manufacturers

- Natural resource dependency (electricity)

- Regularly scheduled halvings (for Bitcoin and some others) creating supply shocks

- High barriers to entry favoring large-scale operations

- Mining rewards generally decrease over time

PoS Economics

- Creation of staking services and liquid staking derivatives

- Capital efficiency concerns with locked funds

- Potential for compounding returns through restaking rewards

- Lower barriers to entry but minimum stake requirements

- Often creates deflationary pressure through token burns and lower issuance

Security Considerations

Both mechanisms have different security models with unique strengths and vulnerabilities.

PoW Security Model

- Strengths:

- Time-tested (Bitcoin has secured billions in value for over a decade)

- Requires significant physical resources to attack

- Miners have “skin in the game” through hardware investments

- Vulnerabilities:

- 51% attacks if hash power becomes centralized

- Selfish mining strategies

- Risk of miner extractable value (MEV)

PoS Security Model

- Strengths:

- Economic penalties for malicious behavior

- Attack cost scales with network value

- No need for continuous energy expenditure

- Vulnerabilities:

- Nothing-at-stake problem (mitigated by slashing)

- Long-range attacks (various solutions implemented)

- Initial distribution concerns

- Governance attacks through token concentration

Scalability and Performance

The scalability limitations of blockchain networks have pushed development of various solutions, with consensus mechanisms playing a crucial role.

PoW Scalability Challenges

- Limited transaction throughput (Bitcoin: ~7 transactions per second)

- High energy cost per transaction

- Longer confirmation times for security

- Layer 2 solutions needed for scalability (Lightning Network)

PoS Scalability Advantages

- Faster block times possible

- Higher transaction throughput

- More energy-efficient scaling

- Often paired with sharding for further scalability

Real-World Implementations

Several major blockchain networks showcase these consensus mechanisms in action.

Notable PoW Blockchains

- Bitcoin: The original and largest PoW blockchain, prioritizing security and decentralization over transaction speed

- Litecoin: Modified Bitcoin code with faster block times and different hashing algorithm

- Monero: Privacy-focused cryptocurrency using RandomX algorithm to maintain ASIC resistance

- Dogecoin: Originally created as a meme coin, uses Scrypt algorithm similar to Litecoin

Notable PoS Blockchains

- Ethereum: Transitioned from PoW to PoS in September 2022 with “The Merge”

- Cardano: Developed with academic research, uses Ouroboros PoS protocol

- Solana: High-performance blockchain using a hybrid consensus including Proof of History

- Polkadot: Multi-chain network using Nominated Proof of Stake (NPoS)

- Cosmos: Interconnected blockchain ecosystem using Tendermint PoS

Future Trends and Developments

The blockchain landscape continues to evolve with innovations in consensus mechanisms.

Hybrid Approaches

Several projects are exploring combinations of PoW and PoS elements:

- Delegated Proof of Stake (DPoS)

- Proof of History + Proof of Stake (Solana)

- Proof of Authority for private/permissioned blockchains

Emerging Alternatives

New consensus mechanisms address specific limitations:

- Proof of Space and Time (Chia)

- Proof of Capacity (Signum)

- Proof of Transfer (Stacks)

- Proof of History (component of Solana’s system)

Regulatory Considerations

As blockchain adoption grows, regulatory scrutiny increases:

- Environmental concerns pushing toward PoS or other efficient alternatives

- SEC evaluations of staking as potential securities

- Energy consumption regulations affecting PoW mining operations

FAQ

Which consensus mechanism is more secure, PoW or PoS?

Both mechanisms can provide strong security when properly implemented. PoW has the longer track record with Bitcoin’s unblemished security history, while PoS introduces different security assumptions. PoW security scales with energy consumption, whereas PoS security scales with economic value locked in the system. The specific implementation and network size matter more than the mechanism itself for practical security.

Will Bitcoin ever switch to Proof of Stake?

It’s highly unlikely. Bitcoin’s community strongly values the security model and proven track record of Proof of Work. Any attempt to change Bitcoin’s consensus mechanism would likely result in a contentious hard fork, with most of the community continuing to support the original PoW chain. Bitcoin’s identity is deeply tied to its PoW mechanism and the associated energy expenditure as a security feature.

How does staking work, and can anyone participate?

Staking involves locking up cryptocurrency tokens as collateral to participate in transaction validation on a PoS network. While anyone can participate in theory, most networks have minimum staking requirements. Users with smaller amounts can join staking pools or use exchange staking services. Rewards typically range from 3-15% annually, depending on the network and the percentage of total supply being staked.

What happened during Ethereum’s transition from PoW to PoS?

Ethereum completed “The Merge” in September 2022, transitioning from Proof of Work to Proof of Stake. This required running a parallel PoS chain (the Beacon Chain) alongside the original PoW chain before merging them. The transition reduced Ethereum’s energy consumption by approximately 99.95%, changed the token economics by reducing new ETH issuance, and maintained network operation without disrupting the existing state or transaction history.

Are there environmental benefits to using PoS over PoW?

Yes, the environmental benefits are substantial. PoS networks consume orders of magnitude less energy than comparable PoW networks. For example, Ethereum’s transition to PoS reduced its energy usage from about 112 TWh per year (comparable to the Netherlands’ entire energy consumption) to just 0.01 TWh. PoS also eliminates the e-waste problem associated with specialized mining equipment that quickly becomes obsolete in the competitive PoW mining industry.