Crypto Staking Explained Simply

Crypto staking is a way to earn rewards by locking up your cryptocurrency to help secure a blockchain network. Think of it like earning interest on a savings account, but for the digital age. Instead of keeping your crypto in a wallet doing nothing, staking puts it to work and rewards you for participating in the network’s operations.

What Is Crypto Staking?

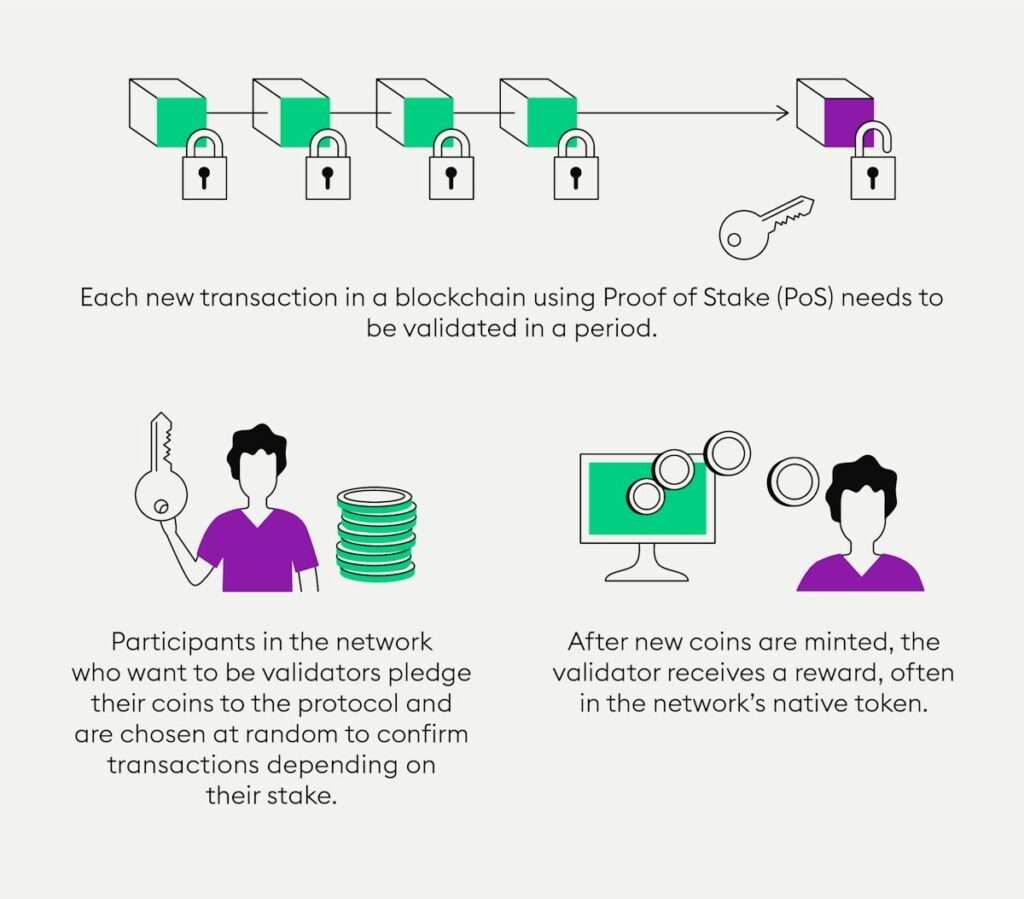

Staking is part of a consensus mechanism called Proof of Stake (PoS), which many blockchains use to validate transactions and maintain security. When you stake your crypto, you’re essentially putting up collateral to become a transaction validator or to support validators.

The network then rewards you with additional cryptocurrency for contributing to its security and operations. The more crypto you stake and the longer you stake it, the more rewards you can potentially earn.

How Staking Works: Step by Step

- Choose a crypto that supports staking – Not all cryptocurrencies can be staked. You need coins that use a Proof of Stake model like Ethereum, Cardano, Polkadot, or Solana.

- Meet minimum requirements – Some networks require minimum amounts to participate. For example, Ethereum requires 32 ETH to run your own validator, but staking pools allow you to join with much less.

- Select your staking method – You can:

- Run your own validator node (technical, requires dedicated hardware)

- Join a staking pool (simpler, lower entry barriers)

- Use an exchange’s staking service (easiest but less control)

- Lock up your cryptocurrency – Your staked assets will be locked for a period of time, which varies by blockchain.

- Earn rewards – As the network processes transactions, you earn rewards proportional to your stake.

Staking Returns Comparison

| Cryptocurrency | Average Annual Return | Minimum Stake | Lock-up Period |

|---|---|---|---|

| Ethereum (ETH) | 4-7% | Variable (pools allow any amount) | Until network allows withdrawals |

| Cardano (ADA) | 4-6% | No minimum | No lock-up |

| Polkadot (DOT) | 10-14% | Variable by parachain | 28 days unbonding |

| Solana (SOL) | 5-7% | No minimum | ~3 days cooldown |

| Cosmos (ATOM) | 8-10% | No minimum | 21 days unbonding |

*Note: Returns fluctuate based on network participation and other factors. Data above is approximate as of publication date.

Benefits of Staking

Staking offers several advantages for cryptocurrency holders:

- Passive income – Earn returns while holding crypto you already own

- Network participation – Help secure and operate the blockchain

- Energy efficiency – PoS uses far less electricity than mining (Proof of Work)

- No specialized hardware needed – Unlike mining, staking doesn’t require expensive equipment

- Lower entry barrier – Staking pools make it accessible to anyone, even with small amounts

Risks and Downsides

Staking isn’t without risks. Before you start, consider these potential downsides:

- Lock-up periods – Your crypto may be unavailable for days or weeks when you want to unstake

- Price volatility – If the token’s value drops significantly, staking rewards might not offset losses

- Validator risks – If you or your validator behaves maliciously or makes errors, you could lose part of your stake (slashing)

- Technical complexity – Running your own validator requires technical knowledge

- Smart contract risks – Bugs or exploits in staking contracts could lead to loss of funds

Types of Staking

Direct Staking

Running your own validator node gives you maximum control and rewards but requires technical expertise and often larger amounts of cryptocurrency.

Delegated Staking

You delegate your tokens to someone else’s validator node. Less technical but you share rewards with the validator operator.

Liquid Staking

Services like Lido provide “liquid staking tokens” representing your staked assets, allowing you to use your staked value elsewhere in DeFi while still earning staking rewards.

Cold Staking

Some networks allow staking from cold wallets (offline storage), enhancing security while still earning rewards.

Popular Staking Platforms

Beginners often start with exchange-based staking services for their simplicity:

- Coinbase – User-friendly but higher fees

- Binance – Wide range of staking options

- Kraken – Good balance of security and ease-of-use

More advanced users might prefer:

- Decentralized staking platforms – Lido, Rocket Pool

- Hardware wallet staking – Ledger Live supports staking for several cryptocurrencies

- Native wallets – Each blockchain usually has official wallets supporting staking

Staking vs. Other Crypto Earning Methods

Staking vs. Mining:

- Staking requires less energy and equipment

- Mining typically requires specialized hardware

- Mining rewards depend on computational power, staking rewards depend on amount staked

Staking vs. Yield Farming:

- Staking is generally lower risk with more moderate returns

- Yield farming involves more complex strategies and usually higher risk

- Staking supports network security, yield farming supports liquidity

Staking vs. Traditional Savings:

- Staking typically offers higher returns than bank interest

- Staking carries more risk and volatility

- Bank deposits have government insurance; staking has no such protection

Future of Staking

Staking continues to grow in popularity as more networks transition to Proof of Stake models. Innovations are making staking more accessible:

- Integration with traditional finance platforms

- Better liquid staking solutions

- Improved security measures

- Cross-chain staking opportunities

- Institutional staking services

As regulators clarify the status of staking, we may see more standardized offerings and potentially tax implications becoming clearer for stakers.

Frequently Asked Questions

Is staking cryptocurrency safe?

Staking through reputable platforms is generally safe, but always carries some risk. The main risks include price volatility of the staked asset, potential slashing penalties for validator errors, smart contract vulnerabilities, and lock-up periods that prevent quick selling during market downturns.

How much can I earn from staking?

Staking rewards typically range from 3% to 15% annually, depending on the cryptocurrency, network participation, and validator performance. Remember that these returns are paid in the staked cryptocurrency, so their dollar value fluctuates with the crypto’s market price.

Do I need technical knowledge to stake crypto?

Not necessarily. While running your own validator node requires technical expertise, staking through exchanges or staking pools is designed to be user-friendly. Many platforms make it as simple as pressing a “stake” button after selecting the amount you want to commit.

Can I unstake my crypto whenever I want?

This depends on the blockchain. Some networks like Cardano allow immediate unstaking, while others like Ethereum or Polkadot have mandatory “unbonding periods” that can last days or weeks before your crypto becomes available again.

Are staking rewards taxable?

In most countries, staking rewards are considered taxable income. They’re typically taxed at their value when received, not when eventually sold. However, tax regulations for crypto vary by country and continue to evolve, so consult with a tax professional for guidance specific to your situation.